20+ Mortgage eligibility

A liquid asset is cash on hand or an asset that can be readily converted to cash. Enables people to buy a new-build property with a small deposit.

New Home Checklist Printable New Home Checklist Buying Your First Home Buying First Home

Lenders mortgage insurance LMI can be expensive.

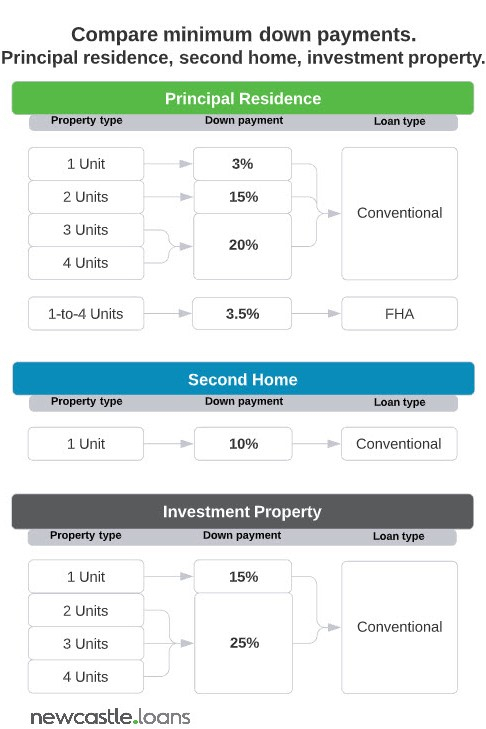

. Current minimum mortgage requirements for HomeReady and Home Possible Loans. Conventional loans require just 3 down and 20 down is required to avoid mortgage insurance. Indian Maximum age considered at the time of loan maturity.

FHA expands mortgage eligibility for borrowers affected by COVID-19. NW IR-6526 Washington DC 20224. Homebuyers who have liquid assets of at least 20 of the purchase price of the property MAY not be eligible to use the Maryland Mortgage Program.

And other applicable policy guidance HUD Handbook 42651 Home Mortgage Insurance Condominiums. However some borrowers making a 20 down payment or more on a one-unit home may be eligible for a property inspection waiver PIW and can skip a home appraisal. Gifts in the form of cash or equity are generally considered liquid assets.

The Food and Nutrition Act of 2008 limits eligibility for SNAP benefits to US. Discover how we can help you. 2022 USDA mortgage May 17 2022 Mortgage discount points explained January 13 2022 You Dont Need A 20 Downpayment To Buy A Home February 20 2019.

The Mortgagee Letter ML and this Guide define the requirements for obtaining. Borrowers can qualify with a credit score as low as 620 but may be offered better pricing with a score above 680. Federal government websites often end in gov or mil.

Chapter 11 of HUD Handbook 41501 Valuation Analysis for Home Mortgage Insurance and any Mortgagees Letters that discuss section 234 requirements. We welcome your comments about this publication and your suggestions for future editions. You can get a 025 percent rate discount if you have a KeyBank.

USDA eligibility and income limits. FSCS protects customers when authorised financial services firms fail. The Freddie Mac Home Possible mortgage offers outstanding flexibility to fit a variety of borrower situations.

2022 USDA mortgage May 17 2022 Mortgage discount points explained January 13 2022 You Dont Need A 20 Downpayment To Buy A Home February 20 2019. If your equity is under 20 and if you have a good credit rating you may still be able to refinance but you might have to settle for a higher interest rate or mortgage insurance. SNAP eligibility has never been extended to undocumented non-citizens.

The Eligibility Matrix provides the comprehensive LTV CLTV and HCLTV ratio requirements for conventional first mortgage loans eligible for delivery to Fannie Mae. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. FannieMaes HomeReady Mortgage allows low-income borrowers with stable credit to purchase a home with a minimal down payment.

Fortunately KeyBank lets you borrow up to 90 percent of your homes value in a first and second mortgage if you qualify. USDA eligibility and income limits. 2022 USDA mortgage May 17 2022 Mortgage discount points explained January 13 2022 You Dont Need A 20 Downpayment To Buy A Home February 20 2019.

The mortgage loan requirements for these conventional low-down-payment programs include. USDA eligibility and income limits. At Rocket Mortgage you can cash out up to 100 of your equity with a minimum 620 FICO Score.

Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. You could be entitled to compensation of up to 85000.

Citizens and certain lawfully present non-citizens. Home loan eligibility in India and across the globe is judged on your perceived ability to pay back. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property.

Equity is the difference between how much you owe on your mortgage and the homes market value. Talk to your lender if you have one in mind about any additional details and requirements for what they can offer you. Eligibility now includes National Guard members with at least 90 days of active service including at least 30 consecutive days under Title 32 Sections 316 502 503 504 or 505.

Specific requirements for non-citizens who may be eligible have changed substantially over the years and become more complicated in certain areas. Lenders use this number to calculate. Government has an equity share of up to 20 up to 40 in London until you repay the equity loan.

The Eligibility Matrix also includes credit score minimum reserve requirements in months and maximum debt-to-income ratio requirements for manually underwritten loans. Homebuyers must contribute 80 of the homes price for example with a minimum 5 deposit and up to 75 mortgage. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination.

Use Our Mortgage Qualification Calculator. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. This is the dollar amount you put toward your home cost.

You can and should calculate your mortgage payment for. Effectively your home loan eligibility is determined by the lender based on. Purchase Loans and Cash-Out Refinance.

Second mortgages come in two main forms home equity loans and home equity lines of credit. With Home Possible were all for helping you capitalize on opportunities to meet the financing needs of very low- to low-income borrowers looking for low down payment options and flexible sources of funds. Second mortgage types Lump sum.

VA-guaranteed loans are available for homes for your occupancy or a spouse andor dependent for active duty service members. Have at least 15 percent to 20 percent equity in your home. If you bought a 600000 house with a 5 deposit of 30000 then your LMI premium could cost over 22000 based on Finders LMI estimator.

The gov means its official. HomeReady Mortgage. Getting a mortgage can involve a lot of steps and you wouldnt want to get too far into the process before realizing you wont qualify after all.

Before sharing sensitive information make sure youre on a federal government site. The minimum down payment of 3 can come from multiple sources including gifts or grants. Prior to ConsumerAffairs he was a programming consultant for radio and TV stations in some 20 markets around the US as.

In London homebuyers.

Types Of Home Loans Amerhome Mortgage

New Home Checklist Printable New Home Checklist Buying Your First Home Buying First Home

2

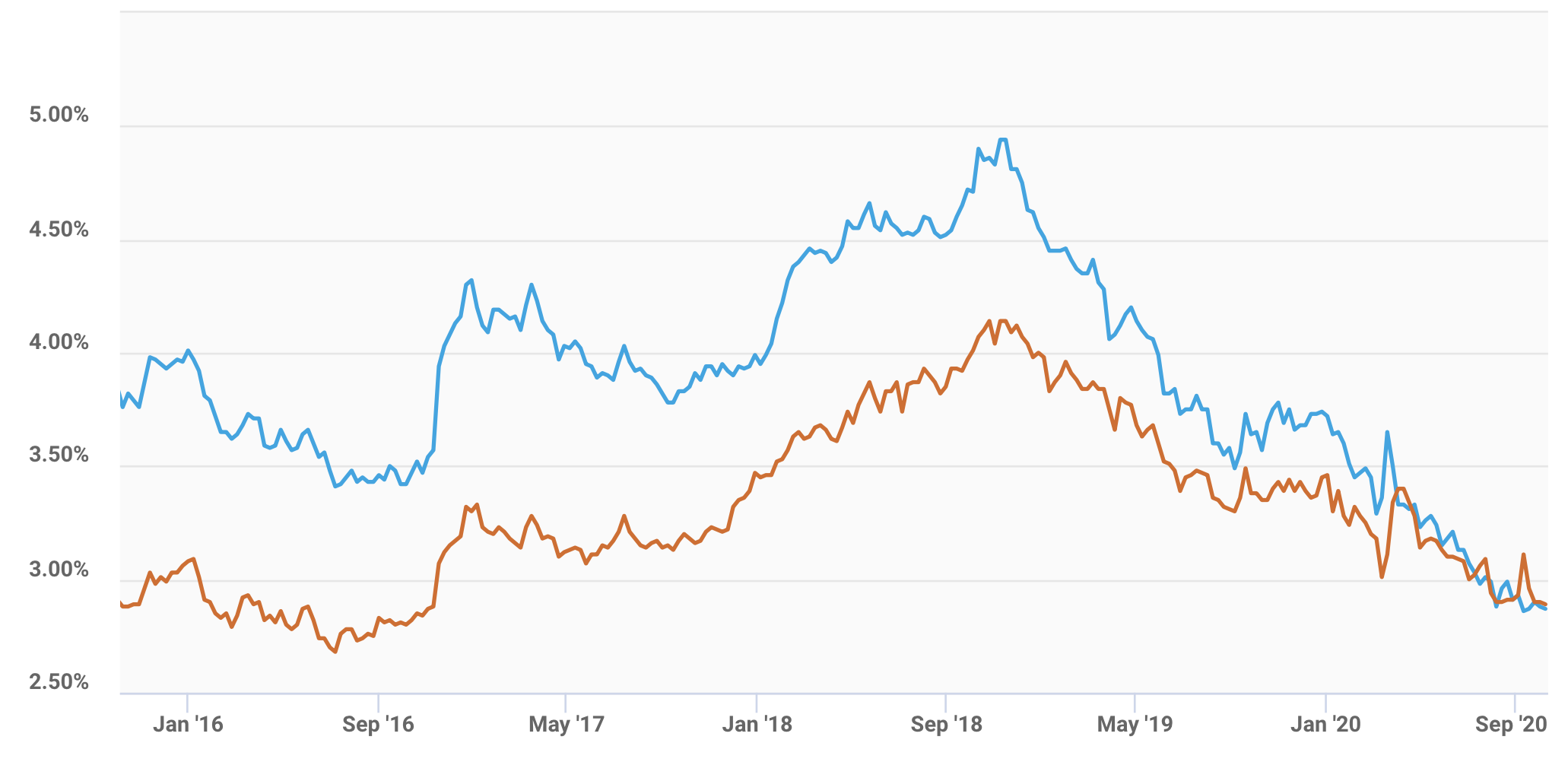

California Mortgage Rates Trends 30 Year Fixed Better Than Arm Loan

/dotdash_Final_Why_Structured_Notes_Might_Not_Be_Right_for_You_Nov_2020-01-eae4f9726a074ae1b50bca26e257d429.jpg)

Why Structured Notes Might Not Be Right For You

What Is An Fha Appraisal Helpful Checklist Home Appraisal Fha Inspection Fha

A New Way To Achieve Homeownership

2

/Mortgage_Rates-final-72f37273e7994683ac3366ebc810881f.png)

Shopping For Mortgage Rates

20 Construction Hoarding Art You Have To See Architecture Hoarding Design Architecture Board

Principal Residence Second Home Or Investment Property How Occupancy Affects Your Mortgage

Jumbo Loan Without A 20 Down Payment Jumbo Source

How To Make A Flowchart In Word 20 Flowchart Templates

Use These Tips To Pay Off Your Mortgage Early

2

Those Buying A Home In The Bay Area In 2022 Might Want To Hurry

At Halfway Stage 10 Years Of A 20 Year Home Loan Would The Loan Amount Still Pending Be Half Less Than Half Or More Than Half Of The Total Quora